Content Connoisseurs,

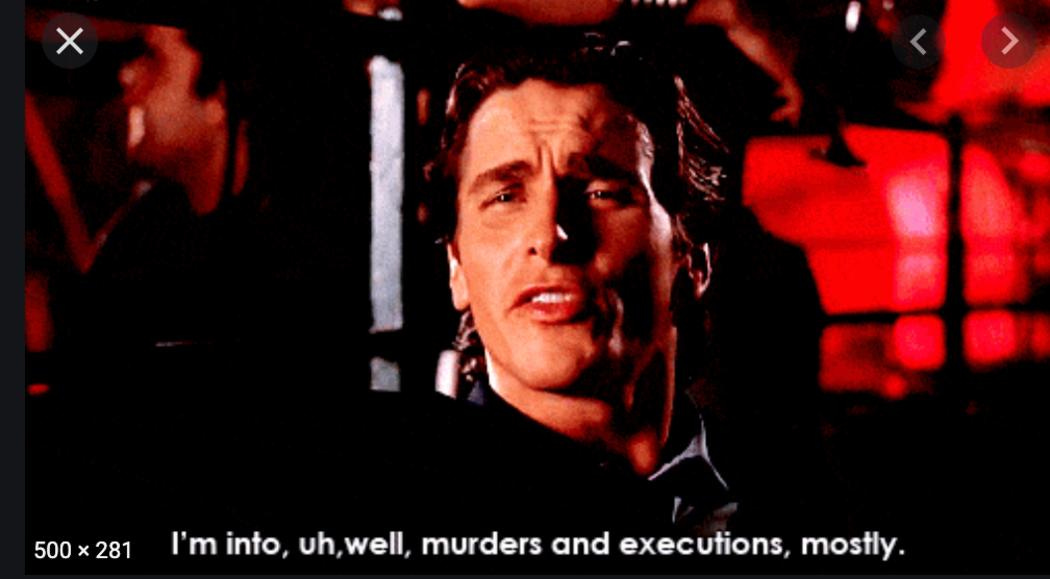

It's M&A Mania out here, Media Merger Melee etc.

Which isn't surprising, but it's happening faster than I would've expected.

And now that there’s momentum among the people who engineer these deals, there will be more, in surprising combinations that only make sense to those people but nonetheless affect the rest of us.

In the last like day or so, there have been two yugely significant deals…

There's AT&T spinning off WarnerMedia: HBO Max + Warner Bros. + CNN + various cable channels with "T" & combining it with Discovery, which makes a lot of doc/reality stuff (and is a big operation I had not ever thought about until they made a strange deal with Tiger Woods).

And there's Amazon buying MGM, which is a more straightforward acquisition of a library. (In my first note to you all, I was genuinely encouraged by MGM's Orion division greenlighting a Sarah Polley movie. That'll never happen again.)

Before speculating on implications for future mergers and for the health of film & TV more generally, I want to say the thing that gets left out of so much coverage in the trades & especially in the business press: thousands and thousands of people are about to lose their jobs. One of them made $52.1MM last year. The vast majority made more like $52K and will have 3 more months on their health insurance. While there's fun/schadenfreude to be had speculating on what'll become of recognizable names at the top, the departments that are most easily combined are less highly-paid, like IT, HR & Payroll. Marginally improving profitability -- by firing middle-class people -- is the reason for these mergers. I didn't really hear it until I myself lost a job, but underneath all this news is a hum of callousness.

So AT&T is spinning off HBO Max. And given that HBOMax was the third most legit streamer after Netflix & D+ (per my elaborate algo), the next logical conclusion the markets will make is that all the smaller streamers aren't viable either. And that may have been priced in already, but the calls will only grow louder.

More specifically, the markets may decide a phone company can't run a streamer. Comcast has dug in on content for more than a decade now, but the pressure for NBCUniversal & Viacom/CBS to merge will only build. I'd bet on it happening within a year. And if not, a similar deal will happen.

(If this seems abstruse, please trust me that you don't need to be a rainmaker M&A banker to get the basics: The Wall Street analysts have observed that these companies are on the downslope (duh) and should get married to each other and fire people. And that's not necessarily because that's a viable path long-run, or because the companies couldn't continue paying for entertainment and providing health insurances to several tens of thousands of employees, but because the combined entity will be a less-bad stock than the separate companies' stocks will be if their streamers don't magically rival Netflix.)

The smaller deal has vast implications too. MGM wouldn't be on the chopping block if its investors thought it was viable. Its investors are private equity people, including this dude who seems like bad news.

So it isn't enough anymore to have yuge IP (Bond, Rocky etc.) in film and scripted & unscripted TV, the capability to finance & run productions (and to theatrically distribute movies in the US). It isn't enough to be a consummate seller, even with a library that throws off cash with rebootable properties.

Now the pressure is on similarly-structured companies with lesser libraries -- Liosnate, STX, & Sony, all of which are publicly traded companies -- to offer themselves up for sale. Of course they were on the downslopes, but now they'll be on the chopping blocks soon.

(And while every valuation here is too big to really be graspable for me, it wouldn't surprise me if the inevitable sales turned out to be for comparatively lower numbers. Bond, Rocky, & the Addams Family selling for $9B seems low.)

So there will be fewer buyers.

And my big concern is that fewer mega-buyers -- and holy shit, are there so few already -- will lead to mandates that are more homogenized i.e. the people you pitch are just going to be holding on to their jobs for dear life, looking for smorgasboards of stuff that feel big/safe/commercial.

Which is the opposite of what I want!

I'm not even asking for much. I swear. I just want buyers who have some feel for their audiences. Like... I can't say I was ever a yuge fan of Comedy Central as a viewer or as a baby producer pitching them, but the people who worked there had a clear mandate and did the homework to go to comedy shows and watch funny stuff and try to buy stuff that the audiences who attended/watched that stuff would like.

Now... I actually don't know that I'm ever going to pitch a buyer like that again.

I can't think of a buyer with expertise in a given genre & a cogent mandate that isn't about to get swallowed or already having its culture upended by a parent company. I'm not optimistic about FX remaining FX at Hulu under Dana Walden's Disney. I guess I could be impressed by the sheer specificity of Netflix's "light indies" division, but... I'm just not the guy who's going to find the silver lining in Netflix's "light indies" division.

In sum:

Tech killed TV with streaming.

Streaming + corona may have killed the theaters.

Wall Street is wringing out fees from the wreckage.

The only wrinkle of hope here is that a wave of proposals for mergers could -- as has become my pet cause -- accelerate the resurgence of anti-trust. There are mergers up for discussion that Biden's FTC would have to look at very, very closely. NBC & CBS may be dinosaurs, but they're also vital news providers. The impending possibility of their combination will horrify a group of people who'd stand to lose their jobs & who could drum up outrage: the press.

Hollywood Forever Y'all,

Max